Wealth Club

Wealth Club

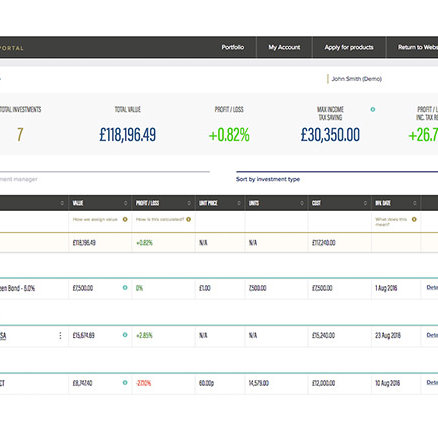

Wealth Club is the UK’s largest investment broker specialising in tax-efficient and alternative investments.

The tax burden for wealthier investors keeps rising. What could high net worth and sophisticated investors do? We can sit and watch the tax raid on property, dividends and pensions – or we could explore alternative investment opportunities.

Venture Capital Trusts (VCT) and the Enterprise Investment Scheme (EIS), for example, are government-backed schemes to encourage investment in young and dynamic British companies. The long-term reward for doing so is the potential to back a winner. The short-term reward is the significant tax reliefs the government offers. These are high risk investments for experienced investors and you could lose your capital. There are also options for experienced investors who are concerned about inheritance tax.

Alex Davies is a property investor and a former board director at Hargreaves Lansdown, the FTSE 100 stockbroker. He set up Wealth Club in 2016 to make tax-efficient investments more transparent, simpler to apply for and easier to monitor.

After selling some of his Hargreaves Lansdown shares and looking around for tax-efficient ways to invest, Alex started making significant investments in VCTs and EIS. He soon realised this area of the market was not well served at all. It was hard to find impartial and trustworthy information. Some were good investments, but it was difficult to separate the wheat from the chaff, not to mention apply and keep track of them.

Wealth Club was named Best Investment Platform two years running at the Growth Investor Awards. Members get regularly updated information on tax-efficient investments – VCTs, EIS and SEIS, IHT portfolios and forestry – plus access to other investment opportunities rarely available elsewhere. Members also normally pay less in charges than they would if they invested directly with the provider, through an adviser, or another broker.

Visit Website

Contact Details

- Telephone 0117 929 0511

- Email enquiries@wealthclub.co.uk

- Website https://www.wealthclub.co.uk/

Abode Affiliates

COPYRIGHT © Abode2 2012-2024