London’s Richest Landlord

09.11.23This prestigious title goes to The Crown Estate and the Grosvenor Group. With significant holdings in central London, these property barons dominate prime real estate.

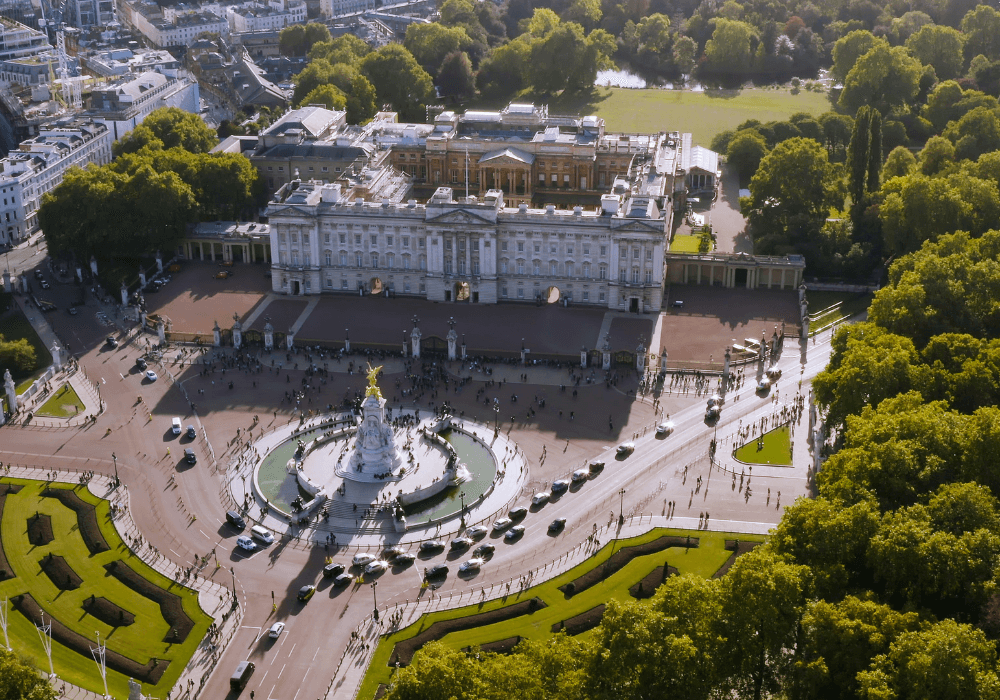

The Crown Estate, in total owns about 115,000 hectares of agricultural land and forests, retail properties, sprawling housing estates and about 55% of UK beaches. In London, the Crown Estate owns most of Regent Street, in fact it owns most buildings on a stretch of the A4201, from Great Portland Street down to Pall Mall – that’s 242 prime locations in central London. The most valuable asset in the Crown Estate’s portfolio is Buckingham Palace, which was valued in 2022 at some $5bn. Technically, under our legal system, the Monarch (currently King Charles III), as head of state, owns the superior interest in all land in England, Wales and Northern Ireland.

The Grosvenor Group’s association with London property began over 340 years ago, developing pastures and swamps into Mayfair in the 1720s, and Belgravia in the 1820s. Hugh Grosvenor, 7th Duke of Westminster born in 1991 is no ordinary landlord; he inherited his title and control of the Grosvenor Estate, worth an estimated £9 billion in 2016, from a lineage that stretches back to Mary Davies’ profitable dowry.

Hugh’s father Gerald was a savvy property market investor, who expanded this legacy by developing high street locations into luxury properties for wealthy clients. At its peak, his empire spanned 300 acres of Belgravia and Mayfair alone.

Square Feet vs Square Metres: A Tale of Two Measures

In real estate terms we often discuss size using square feet or metres depending upon which side of the Atlantic you hail from. For perspective, if we were talking about all combined areas under control by these two powerhouses, it’s an astonishing 7.3 billion square feet.

That’s more than the size of Hyde Park or even Buckingham Palace. Imagine owning a slice of that – you’d be partaking in London’s property cake where each piece is worth £ per bite.

These landlords don’t just hold huge portfolios. They wield a considerable sway in the real estate market.

A Deep Dive into Belgravia’s Property Market

Belgravia, a district in the heart of London, boasts some of the city’s most luxurious properties. From Eaton Square to Elizabeth Street and beyond, it presents a diverse array of architectural gems that span different periods.

In terms of property types in Belgravia, grand Georgian townhouses dominate the scene. These impressive buildings often feature white stucco facades that echo timeless elegance. Yet you’ll also find modern flats and maisonettes sprinkled across this affluent neighbourhood. The price range for these exclusive homes varies considerably based on their location within Belgravia and features they offer. To give an idea about pricing trends here: approximately 62% of homes cost £2 million or more as per recent property data. However, prices have dropped by 20.1% from their peak in 2015 due to unrelenting factors including political uncertainty surrounding Brexit, COVID-19, quantitative tightening, 14 successive base rate hikes, staggering inflation, and general hostility towards ultra-high net worth overseas property investors.

By Ben Williams

Source: www.thelondoneconomic.com

Abode Affiliates

COPYRIGHT © Abode2 2012-2024