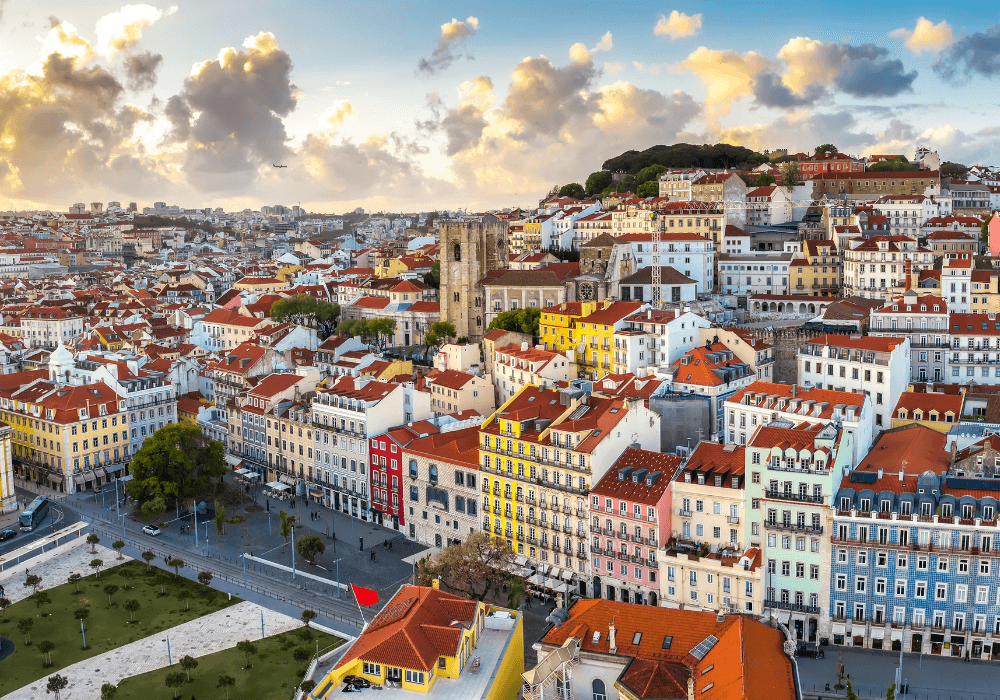

Portuguese Prowess

02.08.23Joana Neto Mestre of MATLAW explains the Portuguese Government’s campaign to combat the national housing shortage crisis

In February 2023, the Portuguese Government announced the “Mais Habitação” (More Housing) campaign. A draft bill was prepared, focused on fighting the housing crisis in Portugal. The primary aims are to increase the supply of housing, simplify the licensing processes of new and renovated construction projects and increase the number of houses available on the rental market. As a result, several measures were proposed by the Government, including highlighting the wind-down of the Golden Visa programme and an increase in tax incentives for long-term rentals as well as changes to the short-term rental regime and the simplification of construction licensing. The final version of the Government bill however, is pending discussion and approval by Parliament.

Golden Visa

The current Golden Visa programme will soon come to

an end. If you are planning on securing a Golden Visa to benefit from a residence permit with negligible mandatory periods of effective stay (maximum 14 days a year), the renewal of existing Golden Visas and family reunification applications are still possible. The permits will be converted into residence permits for entrepreneurs, but the mandatory period of stay in Portugal will still be 7 and 14 days (in

the first and second years onwards, respectively). If you’re faced with the imminent termination of the Golden Visa programme and cannot complete an eligible investment and apply for this permit until the new law comes into force, don’t feel discouraged. For those who dream of becoming.

Portuguese residents and obtaining Portuguese citizenship, there are alternative options for residency under: •Work (and Job Seeker) visa (D1)•Self-employment visa (D2)•Entrepreneur/Start-up visa•Retirement/Passive income visa (D7)•Digital Nomad visa (D8)

Tax Incentives

The government has created tax incentives for landlords to optimise the letting market by reducing the personal income tax rate applicable for long-term rental contracts: the longer the contract, the lower the tax on rental income (between 25% and 5%). In addition, capital gains will be exempted for those (1) selling real estate to the State and Municipalities, and also (2) selling secondary housing and applying the sales proceedings reedemable against an existing mortgage on a taxpayers’ or descendants’ primary residence. There are also new tax incentives, such as a VAT reduction on construction projects, property transfer tax, annual property tax and rental income tax exemption.

Short-Term Rental Scheme

In this sector, the plan is to balance the need for increased housing with short-term rental demand, which contributes significantly to the Portuguese tourism industry. An extra tax contribution will now therefore be payable by property owners conducting short-term rentals in sought-after regions. Also, municipalities will have the right to suspend the issue of new short-term rental licenses in relation to apartments in high demographic areas (except from the Azores and Madeira). By contrast, villa licences for short- term rentals will continue, which is still a good opportunity for those who already have or wish to start a new rental business and invest in a higher value property.

Simplifying Planning Approval

The Government aims to make construction licensing procedures more streamlined, which will encourage investors to promote new real estate initiatives. Two principal measures proposed by Government include replacing prior governmental control with a joint liability cohort of several project stakeholders (architects, developers and contractors), as well as the payment of default interest by public authorities in case of delayed decision making.

Overall, the programme known as Mais Habitação, aims to encourage new housing construction and create significant incentives for mid to long term real estate investment planning. Most importantly, for those who simply wish to acquire a holiday home in Portugal, there is no change.

With regards to the wind-down of the Golden Visa initiative, to protect legitimate expectations of granted and pending Golden Visa applications, the new bill will protect permits and requests already submitted.

www.matlaw.pt

geral@matlaw.pt

(+351) 210 434 150 | 289 356 330

This article is generic, and does not constitute, nor should it be interpreted as constituting legal advice to any concrete case, which will always depend on a careful and thoughtful legal analysis of all circumstances involved.

Abode Affiliates

COPYRIGHT © Abode2 2012-2025