Long Term Perspective In The Stock Markets

02.02.16In his famous poem, If, Rudyard Kipling talks about the virtues of keeping ‘your head when all about you are losing theirs’. The stormy January that hit stock markets around the world has spooked investors, with many panicking about the outlook for the rest of 2016. What is needed is a robust mind-set that shuts out the noise and focuses on the underlying data and to keep a medium to long term perspective.

The emotion gripping investors is understandable. When confidence is low, the temptation is to move into cash and sit on the side-lines until things calm down. But what is a bear market and is this the right strategy? A stock market is said to enter bear market territory when prices fall by at least 20% from their peak. But selling low tends to be the worst thing to do. At times like this it can be best to forget the headlines, log out of your investing accounts and remember you are in for the long haul as selling low can create more problems:

- When do you get back in? You would need to make two correct decisions back-to-back - when to get out and when to get back in.

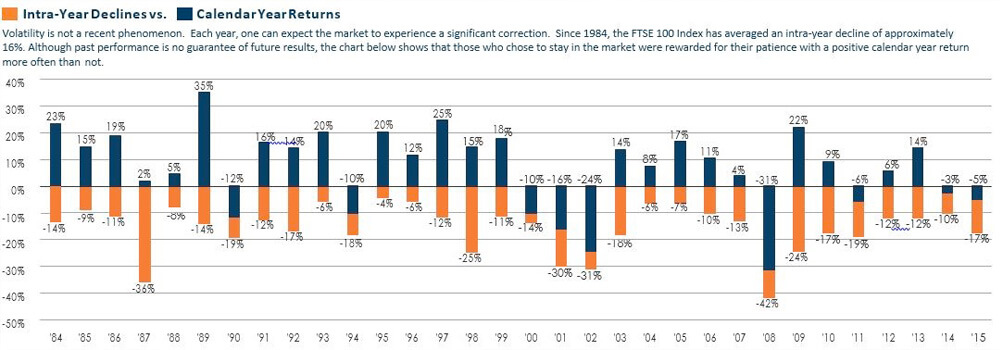

- By going to the side-lines you may be missing a potential rebound. This is not historically unprecedented as shown in the chart below.

Source: First Trust Advisors L.P., Bloomberg. Returns are YTD through 31/12/15. The benchmark used for the above chart is the FTSE 100 Index. The FTSE 100 Index is composed of the 100 largest companies listed on the London Stock Exchange (LSE). Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Returns are based on price.

At times like this you need an experienced captain with nerves of steel to navigate the choppy waters.

Our Chief Investment Officer at SCM Direct, Alan Miller, is one of a handful of highly respected UK fund managers whose 26 years’ experience, across a huge range of asset classes, helps our clients rest easy.

The value of investments can go down as well as up and investors may not recover the amount of their original investment.

SCM Direct is a trading name of SCM Private LLP which is authorised and regulated by the Financial Conduct Authorit

Abode Affiliates

COPYRIGHT © Abode2 2012-2024