Funding a Fruitful Retirement

08.06.16The Alice in Wonderland World of Pension and Investing

The conundrum facing millions of us is how do we fund our old age? This is a question that continues to vex the state, policymakers and individuals, as the public purse, whatever colour the government, will not be able to fund the demands of our aging population. In fact, it is highly likely that state pension provision will shrink, although it is already at a level where many people cannot live on their pensions alone.

Against this backdrop we have a pension and investment industry akin to Alice in Wonderland where very little is as it seems. Heads are firmly planted in the sand, with providers touting high fees, low performing products.

It is time to stand up and ask - where is my hard earned money being invested and how am I really paying? Like so many people, your pension is probably one of your biggest savings options as you strive to ensure OAP does not stand for ‘Old and Poor’ – so do you know what it is invested in?

In June 2016, SCM Direct analysed the latest accounts for 50 of the largest UK corporate pension schemes and 91 Local Government Pension Schemes (LGPS). Our research revealed that within 31 different Local Government Pension Schemes (LGPS), there are 4.9 million total members, 2.2 million of which are invested in hedge funds.

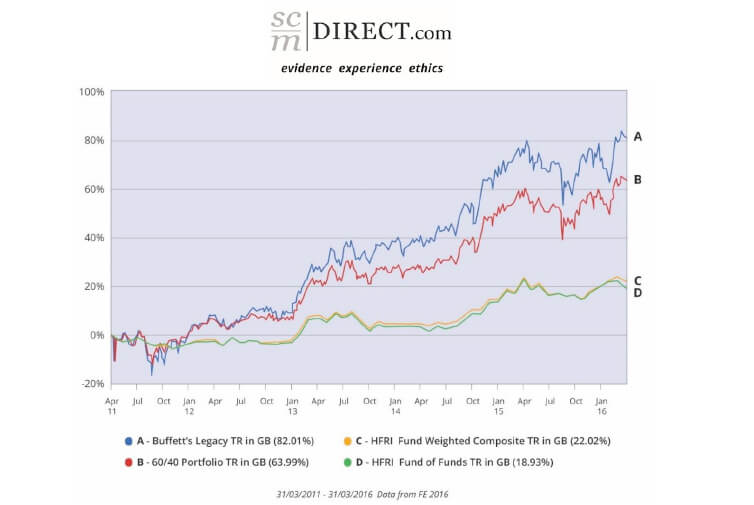

Shockingly, these ordinary savers are paying c.36 times the fees of low cost alternatives, whilst receiving as little as 1/3rd of the performance. We also found that pension funds are not just investing in hedge funds, previously targeted at sophisticated wealthy clients, but increasing their allocations despite dismally low yearly performance.

Lack of Transparency

The key is transparency which is disturbingly poor in pensions. Many pension schemes do not disclose the total costs or a full list of hedge funds within their annual pension fund statements. It appears that even 646 MP’s may be unaware of what their own £523m pension fund is invested in and how much it is costing * So if the industry is not providing transparency, savers need to demand it shines a light in the dark corners of scandalous practices.

Consider that over the last five years a simple 60/40 strategy, or the strategy proposed by Warren Buffett for his own legacy**, would have beaten the average hedge fund by 3 to 4 times.

* http://www.ft.com/cms/s/0/91299538-cf16-11e5-92a1-c5e23ef99c77.html#axzz48Whr8qoo

Abode Affiliates

COPYRIGHT © Abode2 2012-2024